Free zone

What Is a Free Zone?

A free zone (or free trade zone) is a designated economic area within the UAE where businesses enjoy special benefits such as 100% foreign ownership, zero income tax, simplified visa processes, and more.

In short, free zones are business-friendly zones created to attract foreign investment, innovation, and international talent.

There are over 40 free zones in the UAE, each focused on specific industries like media, tech, finance, logistics, and healthcare.

Key Benefits of Operating in a Free Zone

Here’s why businesses love UAE free zones:

100% Foreign Ownership

You don’t need a local partner to set up, perfect for international entrepreneurs.

Full Repatriation of Profits

You can send all profits and capital abroad without restrictions.

Tax Incentives

0% personal income tax

0% corporate tax (until recently; some zones now follow UAE’s 9% corporate tax for certain firms) Exemptions from import/export duties (within the free zone)

Fast and Easy Setup

Business registration is faster, often fully digital, and usually takes just a few days.

Industry-Specific Support

Zones like Dubai Internet City or Sharjah Media City offer facilities, networking, and licenses tailored to your sector.

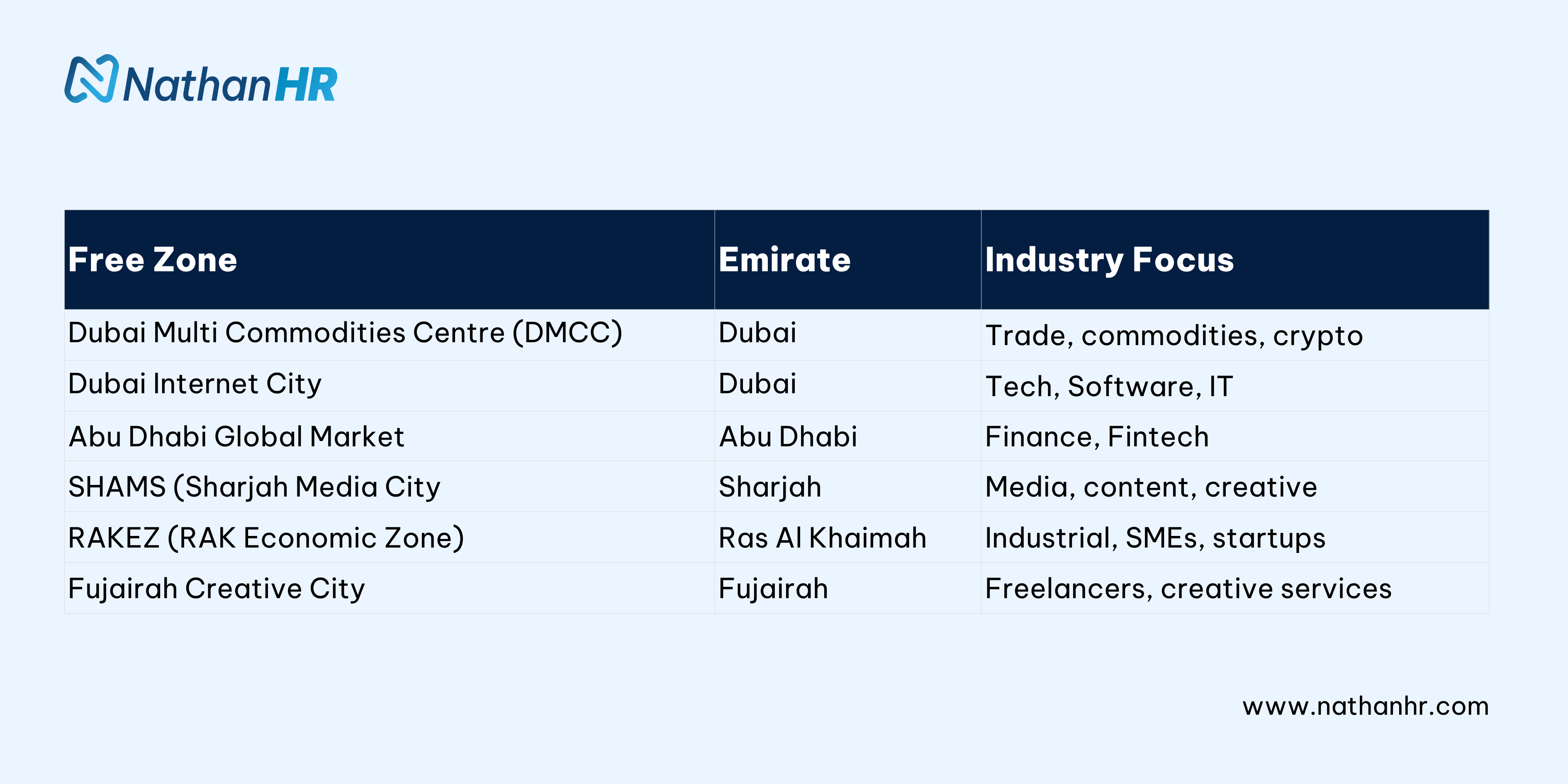

Popular Free Zones in the UAE

Each emirate has its own free zones. Here are some well-known examples:

How Do Free Zones Affect Employment?

If you’re working for a free zone company, here’s what you need to know:

1. Your visa is sponsored by the free zone authority

The free zone (not the company directly) handles your work permit and residency visa. Transfers between zones or to the mainland may require extra approvals.

2. You’re under UAE Labour Law, with slight variations

Most free zones follow Federal Decree Law No. 33 of 2021 (UAE Labour Law), but some apply their own HR rules and procedures.

3. Employment contracts must be registered

The contract is often signed with both the company and the free zone authority.

4. Dispute resolution is handled by the free zone

Employee complaints usually go through the free zone’s internal system, not the Ministry of Human Resources and Emiratisation (MOHRE).

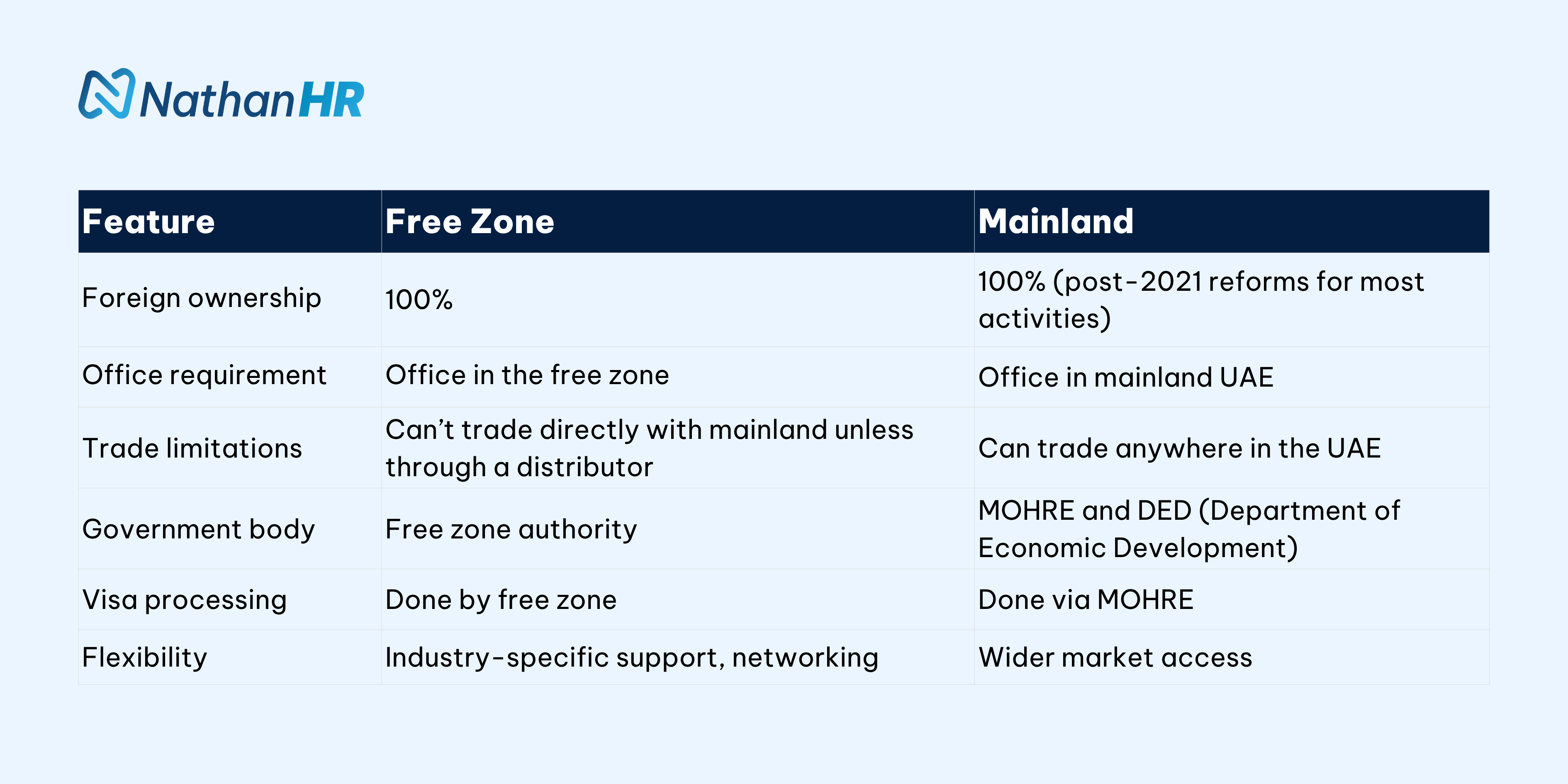

Free Zone vs Mainland: What’s the Difference?

Who Should Set Up in a Free Zone?

Free zones are ideal for:

- Startups and freelancers who want to test the UAE market with minimal risk

- Foreign investors who want full ownership and full profit repatriation

- Industry specialists (e.g. creatives, tech companies, logistics firms) who want to be near like-minded businesses

- Companies not planning to sell directly to the UAE mainland market

Final Thoughts

Free zones are a cornerstone of the UAE’s economy. Whether you're starting a business or joining a company based in one, they offer speed, simplicity, flexibility, and strategic advantages.

But they’re not one-size-fits-all. Choosing the right free zone or understanding your rights as a free zone employee, requires research, clarity, and the right support

Free Zone Employment FAQs

Can I work for a mainland company while holding a free zone visa?

No, your visa must match your employer’s location. Working for another company (mainland or free zone) without proper transfer or permits is not allowed.

Are salaries in free zones different from mainland?

Not necessarily. Salaries are based on market conditions, not location. However, some free zones attract more startups, which may offer equity or flexible terms instead of high salaries.

Can free zone companies offer remote jobs?

Yes! Many free zones actively support remote and hybrid work, especially post-COVID.

Are free zone companies subject to UAE’s new corporate tax?

In many cases, yes, but some free zones offer tax exemptions, especially if you only conduct business outside the UAE. Always consult a tax advisor or the free zone authority.

Can I start a freelance business in a free zone?

Absolutely. Several free zones like Fujairah Creative City, SHAMS, and RAKEZ offer freelance permits for individuals in media, design, consulting, and more.