Final settlements

What Is a Final Settlement?

A final settlement is the full and final payment made to an employee after they leave a company. It includes all dues the employer owes the employee up to the final working day.

In simple terms: Final settlement is the employer’s last paycheck to the employee + any pending benefits. It ensures that both parties close the employment relationship cleanly and legally.

What’s Included in a Final Settlement?

The exact components may vary, but a standard UAE final settlement typically includes:

1. Unpaid Salary

Salary owed up to the employee’s last working day, including partial months.

2. Leave Salary / Unused Annual Leave

Payment for unused accrued annual leave, calculated in working days.

3. End-of-Service Gratuity

A statutory benefit based on length of service and final basic salary. Applies to employees with at least 1 year of continuous service.

4. Notice Period Pay

If the employee served the notice, they’re paid normally. If the notice period was waived or not served, deductions or compensations may apply.

5. Repatriation Costs (if applicable)

For expatriates, companies may cover airfare to home country, if specified in the contract.

6. Other Dues or Deductions

This could include:

- Bonuses or commissions

- Loan deductions

- Company property not returned

- Penalties (if legally justified)

UAE Labour Law on Final Settlements

The UAE Labour Law (Federal Decree Law No. 33 of 2021) provides a framework for fair and timely final settlements.

Timeline for Payment:

The law recommends that final dues be paid within 14 days of the employee’s last working day.

End-of-Service Gratuity Basics:

Calculated based on basic salary only, not allowances.

Paid only if the employee has completed at least 1 year of continuous service.

Amount depends on whether the termination was resignation or dismissal, and total years of service.

Example: An employee earning AED 10,000 basic salary with 5 years of service may be entitled to around 21 days of salary per year for the first 5 years = approx. AED 35,000 in gratuity.

(Note: Exact amounts depend on type of contract and termination.)

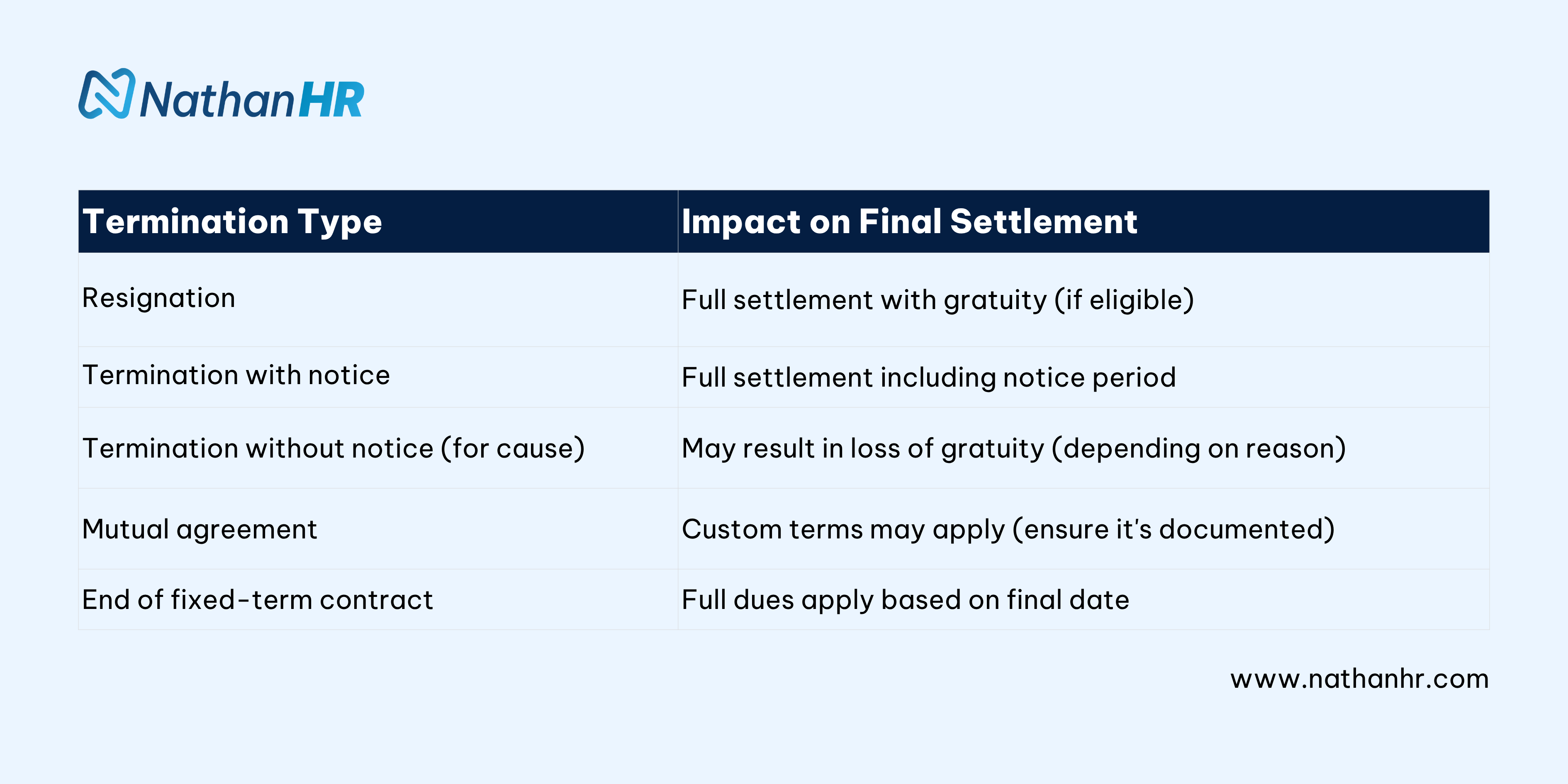

Types of Termination & Impact on Final Settlement

Common Mistakes to Avoid

For employers and HR teams:

- Delaying payment beyond the 14-day limit

- Not documenting leave balances and deductions properly

- Incorrect gratuity calculations (e.g., including allowances)

- Failing to return employee deposits or reimbursements

For employees:

- Not reviewing their final payslip or settlement breakdown

- Leaving without returning company property (can cause deductions)

- Ignoring visa cancellation requirements

Final Settlement Process: Step-by-Step

For Employers:

- Confirm employee’s last working day

- Calculate all dues (salary, leave, gratuity, etc.)

- Get necessary approvals from finance and management

- Cancel work permit and visa

- Disburse final amount within 14 days

- Issue experience letter and final settlement certificate

For Employees:

- Ensure all company assets are returned (laptop, phone, ID, etc.)

- Clear outstanding advances or loans

- Request detailed breakdown of final settlement

- Sign off on final settlement and exit formalities

- Cancel dependent visas (if sponsored)

Sample Final Settlement Components (Example)

.png)

Final Thoughts

The final settlement is more than just an exit formality, it’s a legal and financial obligation that protects both the employer and the employee.

Handled fairly and on time, it ends the employment relationship on a positive, professional note. Whether you’re a company navigating terminations or an employee planning your next move, understanding how final settlements work in the UAE is key to avoiding disputes and staying compliant.

FAQs About Final Settlements in the UAE

1How long does it take to receive a final settlement?

Most companies aim to process it within 14 days, as advised by UAE Labour Law.

Can an employee refuse to sign the final settlement?

Yes, if they disagree with the calculation or deductions. In such cases, disputes can be raised with MOHRE or the free zone authority.

What happens if the employer doesn’t pay the final settlement?

The employee can file a labour complaint with MOHRE. Employers can face fines or legal action for non-compliance.

Is gratuity included in every final settlement?

Only if the employee completed at least one year of service and wasn’t terminated for misconduct.

Is final settlement taxable in the UAE?

No. The UAE does not impose personal income tax, so employees receive the full amount.